Beta Is Best Described as a Proxy Measure of:

For example Ingerski and colleagues found discrepancies between child and parent-proxy reports with parents reporting significantly worse generic HRQOL 14. Given the following information calculate the required return on this firms securities.

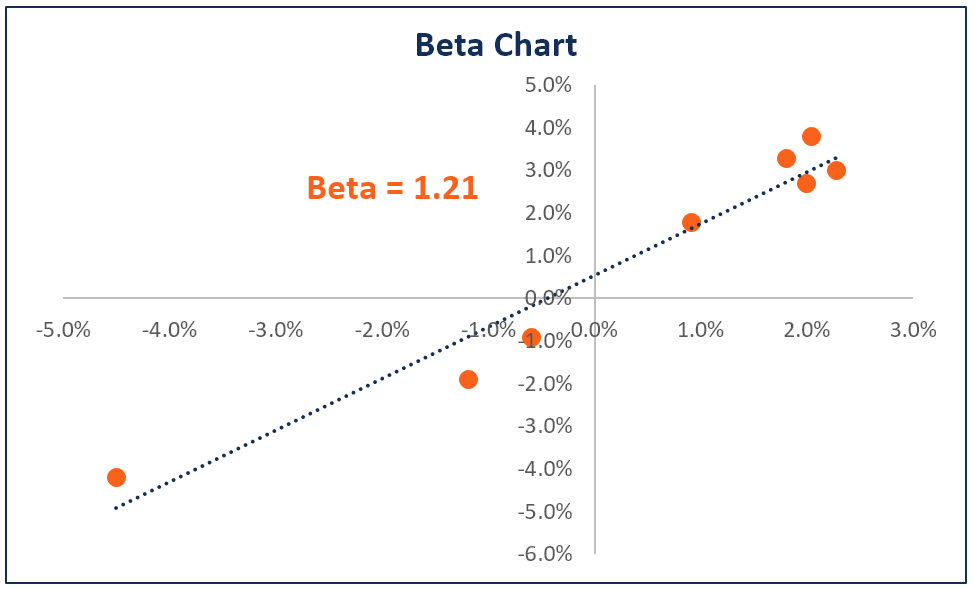

When you plot returns on the Y-axis and risk on the X-axis and fit a line through those returns the slope of that line will be the beta which is the relevant measure of risk according to the CAPM.

. Beta aims to gauge an investments sensitivity to market movements. The standard deviation of possible returns of the asset d. IPD 4-kHz threshold standardized beta 298 p 001.

Beta is 15 the risk-free rate is 6 and the required return on the overall market is 9. If a stock is. In other words it measures the volatility of any security with respect to the overall market volatility.

Beta measures the risk volatility of an individual asset relative to the market portfolio. A good measure of an investors risk exposure if shehe holds only a single asset in herhis portfolio is. Beta is a measure of a stocks sensitivity to which type of risk.

It is a measure of the funds volatility relative to other funds. The beta estimate based purely on historical data known as the unadjusted beta is not a good indicator of the. Beta is the historical measure of risk of any individual stock or portfolio against the risk of the market portfolio.

Beta is a statistical measure of the volatility of a stock versus the overall market. Eurodollars are best described as _____. The Beta coefficient is a measure of sensitivity or correlation of a security Marketable Securities Marketable securities are unrestricted short-term financial instruments that are issued either for equity securities or for debt securities of a publicly listed company.

A nondiversifiable risk b unsystematic risk c total risk d diversifiable risk. The expected value of the assets returns e. A theory that describes what types of.

Let us consider the following example to understand beta intuitively. What term best describes an expected return with multiple states. The BETA in general can be lured into traps or defeated with clever use of tactics but when led by a Superior the BETA become noticeably smarter to the extent where it understands the concepts of human tactics.

A stock has 20 percent more market risk than the market portfolio. For the two measures that were previously nonsignificant ABR and IPD age and noise exposure are not significant predictors of the differential measure and only the audiometric threshold significantly predicts performance. A beta above 1 means a stock is more volatile than.

This is the one true threat to victory in any engagement. It is a historical beta adjusted to reflect the tendency of beta to be mean-reverting the CAPMs beta value will move towards the market average of 1 over time. Beta is best described as a measure of.

Nondiversifiable risk unsystematic risk diversifiable risk O total risk O unique and firm specific risk Preferred stock is like debt primarily because preferred stockholders do not have an ownership claim nor do they have any claim on the residual income of the firm. Smart beta funds are constructed on underlying measures such as volatility or earnings and have been described as a modest mix of. O All the answers are incorrect.

The beta of a potential investment is a measure of how much risk the investment will add to a portfolio that looks like the market. Beta is a measure of a stocks sensitivity to which type of risk. Beta is a risk-reward measure from fundamental analysis to determine the volatility of an asset compared to the overall market.

Beta is best described as a measure of. The correlation coefficient with the market portfolio b. It measures a stocks volatility relative to the market as a whole.

A nondiversifiable risk. Beta is a measure of the volatility or systematic risk of a security or portfolio in comparison to the market as a whole. ABR 1-kHz threshold standardized beta 306 p 001.

What does a beta of 12 indicate. The beta for an average risk security is 1. What type of security if any has a zero beta.

Which of the following indexes would be most the appropriate proxy to measure the return of the market portfolio in the CAPM. Parent-proxy measures in conjunction with self-report measures provide a broader viewpoint of the childs HRQOL 113. It is used in the capital asset pricing model.

The assets Beta value. Slope of the risk-return line or the CAPM risk measure. Adjusted beta tends to estimate a securitys future beta.

While a T-bill is considered risk-free with a beta of 0. The beta of a portfolio is the slope of the risk-return line or the CAPM risk measure. Which one of these is commonly used as a proxy for the market portfolio.

Consider the daily returns of Google Inc. The BETA are usually commanded by the Superior a BETA strain best described as a biological quantum computer. Which of these is commonly used as a proxy for the market portfolio.

The normal probability distribution function c. It is not an absolute measure of volatility.

Usa Vpn Unblock All Best Vpn Best Vpn Master App Mobile Data

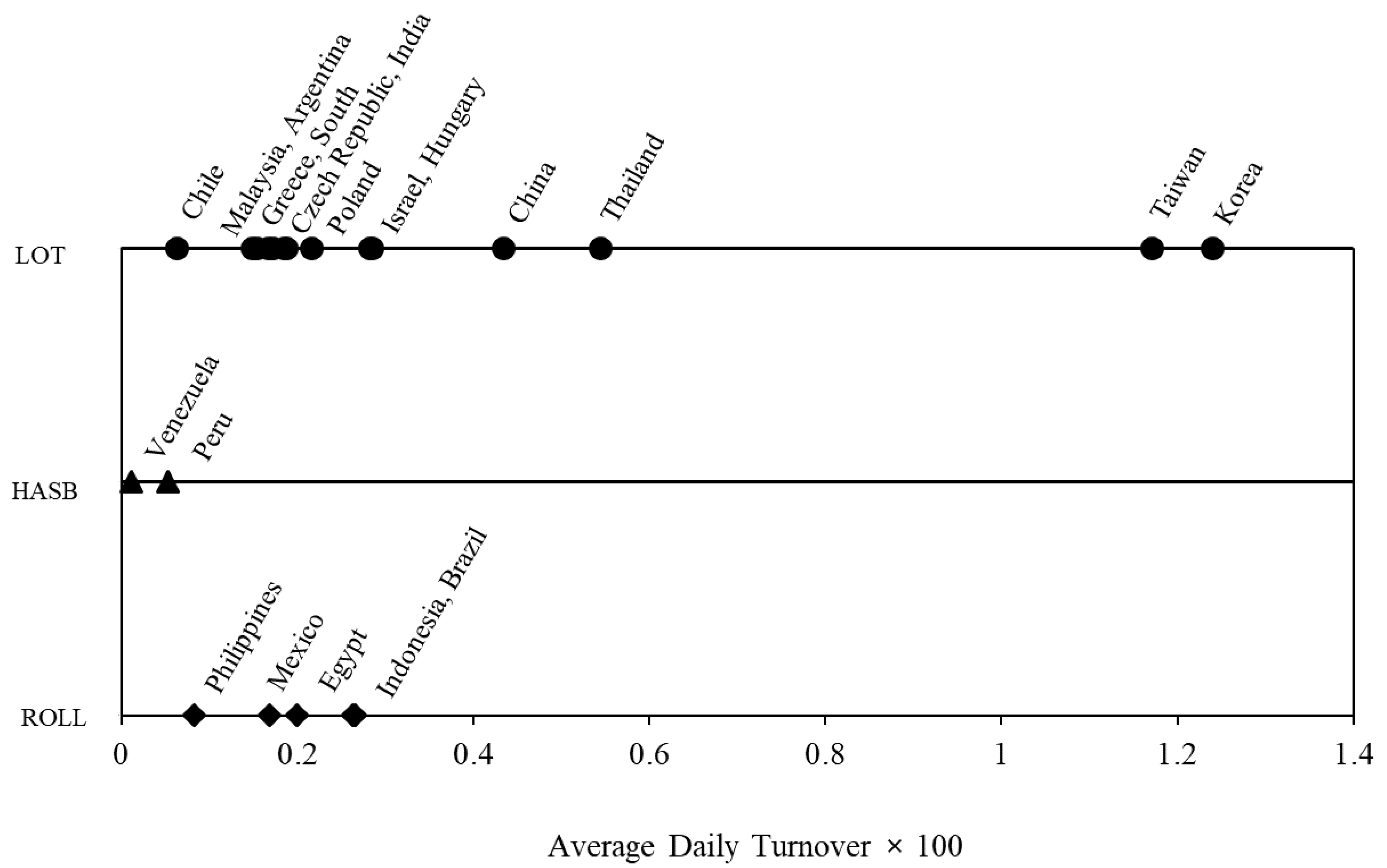

Economies Free Full Text Which Liquidity Proxy Measures Liquidity Best In Emerging Markets Html

Tekwire Call 8448177350 For Network Security Solutions Network Security Security Solutions Web Development

/BetaFinvizScreener-18bccb1de131439b826baa0193e877a1.jpg)

How Does Beta Measure A Stock S Market Risk

/CAPM2-cc8df29f4d814b1597d33eb7742c9243.jpg)

How Does Beta Reflect Systematic Risk

Serif Releases Affinity Photo For Mac Photoshop Plugins Professional Photo Editing Software Photo Editing Software

:max_bytes(150000):strip_icc()/BetaFinvizScreener-18bccb1de131439b826baa0193e877a1.jpg)

How Does Beta Measure A Stock S Market Risk

Keto Advanced 1500 Reviews In 2022 Keto How To Increase Energy Natural Supplements

Systematic Risk Learn How To Identify And Calculate Systematic Risk

Does Bone Density Affect Weight In 2022 Bone Density Osteoporosis Bones Healthy Bones

Ntc Thermistors And You Converting An Adc Analogread Value Into A Temperature Integer Operations Interactive Charts Language Functions

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_the_Best_Way_to_Measure_the_Total_Market_Jan_2020-0d59d1aa9619444795d963d49c7422da.jpg)

Comments

Post a Comment